BTPN's Jenius and Virtual Credit Cards

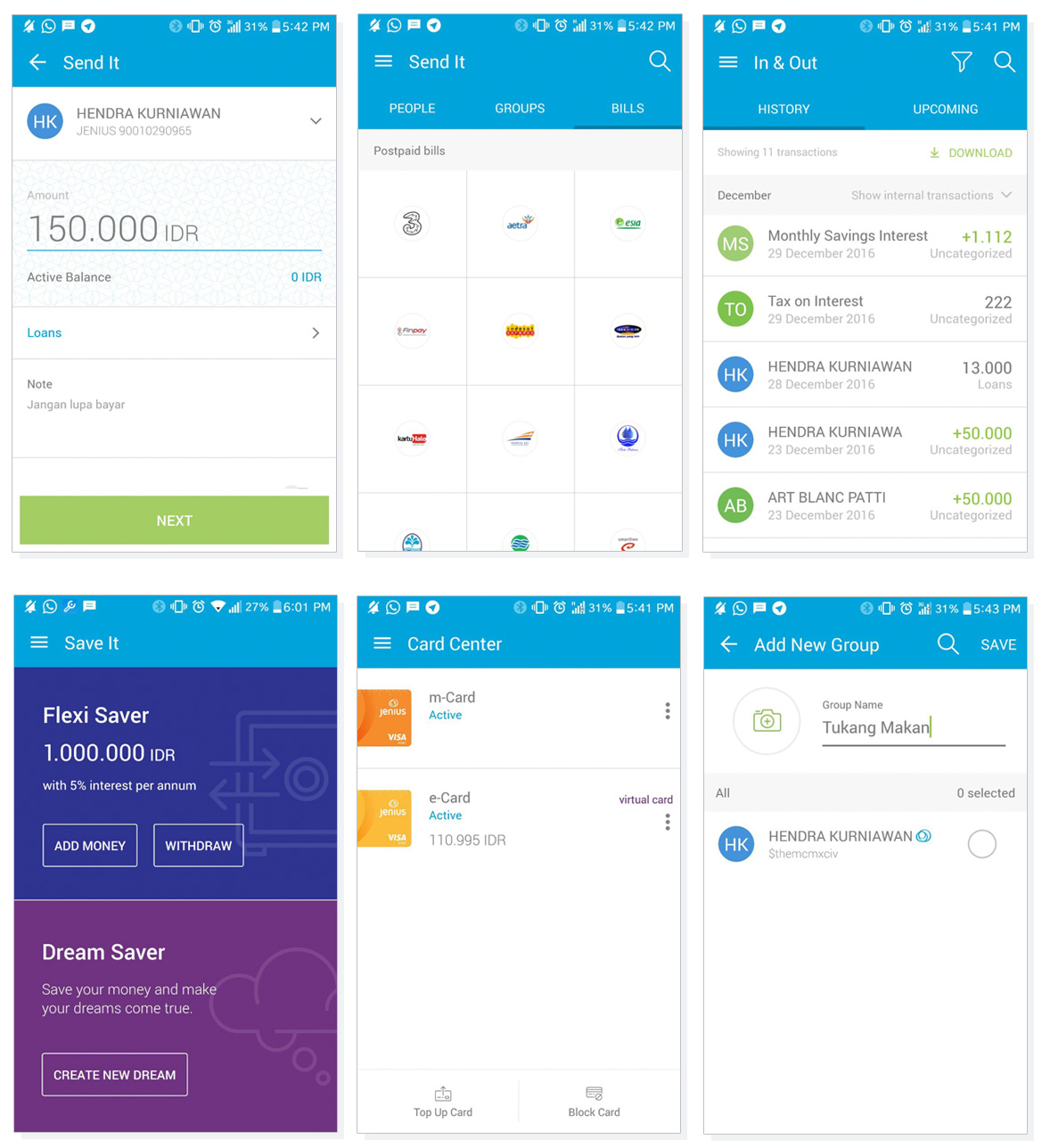

Illustration by Jenius

Shopping without Credit Card

The perks of having a VCC (Virtual Credit Card) is that I now can shop online by using Credit Card as payment method without having to use a real credit card. A real credit card, requires effort to apply for some folks. And I used to be rejected several times too back then. Not to mention the huge bill that came after it, because you simply didn't note your purchases.

It becomes a hassle to purchase small things over the internet such as apps, or maybe subscription based services like Netflix or Spotify. Remember that one friend who always asks for your credit card prior purchasing a Smule VIP membership? Or perhaps, is it you?

What is a Virtual Credit Card?

Virtual Credit Card or VCC is a non physical credit card which number is generated by the issuer. In the case of Jenius' virtual card, you don't have to borrow from the bank. Instead, you must top up certain balance from the physical card (your bank account) to the virtual card (eCard), then purchase things using the balance in the eCard. I will explain later in my experience below.

The Experience

First encounter

I saw the name inside a group chat of mine who fancy exhibitions. We were planning to go to Brighspot Market. It offered a free entrance fee if we download Jenius app and got it activated. So I went up downloading it because I'm such a cheapskate. But who knows what it may lead me up to?

I've finished downloading it without knowing what it is. It's such a weird name to choose for a banking product, really. I had no idea at all of what “Jenius” might be associated to. Being a quirk, it's easy for me to download and register for a new app. So, without hesitation, I registered and followed the instructions very carefully.

Registering

To be honest, this is one of the most well designed Indonesian app in the Play Store. Seriously. Indonesian apps on Play Store are mostly crappy in terms of design. I wonder if it's because Java is such a difficult language to speak. Okay I'm not going to talk about this right now.

Upon registering, I was asked for a photo of my ID Card (KTP), Tax ID (NPWP), and a selfie of myself holding my ID Card (whew, seriously!) This is cool and rempong at the same time. Cool because it's an OCR, and rempong because I need to stuff my cards out of my wallet and do silly pose with them for a free entrance fee.

And what the heck

A few days after I registered Jenius—without knowing what it was—I received a phone call identifying herself as a BTPN representative. She asked me where she could send my accound card. I was like “What the heck?” Have I just registered myself for a new bank account? I felt insecure because now I have two separate bank accounts. It's like splitting your soul into two. Okay I'm being dramatic.

I then told her my office address.

The card's arrived, now what?

To my surprise, the packaging is in a good shape. Meaning: I never seen one banking product like this before. It's in striking orange, with a phone accessory as a bonus. The card itself is kind of hip. It has a ruler functionality that I never use even until now. But seriously, this is one of a kind. And I can't believe that I could actually open up a new bank account without even having to go to the bank and present myself. This really fits for a lazyass like me.

Activating your card

After receiving your physical card, you need to activate it via the app. Then, wait for a few days for the virtual card (or eCard) to be activated by them (maybe they need some time for reviewing your archives). After both cards are activated, you can enter the information of your eCard, such as card number, expiration date, and CCV, for online purchasing.

Shop!

So your eCard is now activated. You can start purchasing things off stores. Watch that TV Shows that you have been dying for on Netflix. Or finally get rid of those sexy–yet–annoying ads on Spotify. Or emptying out your Steam wishlist. Now it's not impossible anymore!

Nevertheless, this virtual card cannot be used in real world situation where you need to swipe the card physically. You will be just provided with the numbers, but no physical card. It's just meant to make your online purchasing easier, safer, and without the need to apply for a real credit card.

From here, you're good to go! But it's okay if you still want to read further…

Features

Here are some basic features you can do with your Jenius app.

Send and Receive

You can send and receive money to other Jenius users using a cashtag (it behaves like a username in general or paypal email address) or BTPN Bank users using an account number. You can also send to a group you've previously created.

Flexi Saver

For saving, it offers a 5% interest annually by placing it in Flexi Saver (don't worry, this Flexi Saver doesn't act like a deposit account. You can withdraw anytime).

Bill split and Pay Me

You can split your bill with other Jenius users (this is basically a request money feature where you can input your own bill and other party's bill. The Pay Me feature does exactly what it says, only without putting your own bill.

End note

Banking for Y Generation

This is somewhat genius, for positioning the product within this market range (oh well now I know why they name it Jenius). I mean, banks are commonly conceived as old boring corporations, where you need to sit in front of a neat and tidy bank teller and talk to him/her to create a new bank account. With its OCR technology put into its app, you are no longer required to present yourself at the bank in the midst of office hour. It's handy and sounds lazy! So me!

Illustration by Jenius